Executive Compensation Solutions

Stand Up To Scrutiny. Manage Stakeholders. Comply With Requirements.

Design, monitor, and communicate executive pay programs that effectively link pay to performance

Today’s executive compensation landscape is more complex than ever. Companies are facing heightened competition for executive talent, pressures from their shareholders, and increased media scrutiny. ISS-Corporate’s leading executive compensation solutions provide you with the resources you need to take your compensation program to the next level.

Streamline your annual executive compensation lifecycle, from strategy setting to implementation and shareholder feedback.

DESIGN EQUITY PLANS

Online equity plan benchmarking tool provides self-service benchmarking of plan features, burn rates, and dilution across various peer groups and industry segments. Evaluation and modeling can be done directly by users via the online tool or results can be delivered by your dedicated advisor.

Advisors deliver holistic, full-service equity plan support using proprietary ISS Equity Plan Scorecard methodology

ANTICIPATE SHAREHOLDER CONCERNS & OPTIMIZE DISCLOSURES

Tell your compensation story, anticipate shareholder concerns, and improve your disclosures

Anticipate Shareholder Issues

- Analyze quantitative pay-forperformance tests

- Assess any prior investor concerns raised

- Understand potential perception of recent pay decisions

Evaluate pay decisions

- Identify problematic pay practices

- Evaluate disclosure of peer set constructions, pay mix, performance metrics, and target setting

Improve your disclosure

- Harness best disclosure practices

- Evaluate appropriateness of Realizable Pay disclosure

- Demonstrate shareholder engagement and responsiveness

BUILD, ANALYZE & MONITOR PEER GROUPS

BUILD

- Leverage the most extensive company-disclosed peer database to identify peer group connections

- Identify a comprehensive list of potential peers

ANALYZE

- Customize a peer scoring model using a multitude of criteria to identify and rank potential peers

- Perform what-if analysis of compensation positioning relative to potential peer groups

MONITOR

- Monitor peer companies and assess their applicability as changes occur during the year

- Review market trends to stay informed on best practices

Leverage Peer Architect’s extensive data and powerful analytics to navigate the complex process of peer selection

TEST PAY-FOR-PERFORMANCE ALIGNMENT

Leverage ISS-Corporate’s analytical approach to uncovering possible pay and performance misalignment. Experienced ISS-Corporate advisors help you uncover contributing factors and suggest adjustments to your plan structure.

1.

Build custom CEO pay analyses that aid in the preparation of compensation plans, identifying potential areas of investor concern, and drafting of your CD&A

2.

Create custom peer groups using the most recent ISS projected peers or company’s disclosed peers as a baseline

3.

Compare pay for performance scores against ISS’ high, medium, and low concern thresholds for a given company

4.

Access projected ISS Pay-for Performance peer groups and Financial Performance Assessment results

BENCHMARK EXECUTIVE AND DIRECTOR PAY

ISS-Corporate acts as an extension of your team, helping you optimize your executive compensation program and align executive incentives with shareholder interests.

Assess alignment of pay incentives and company strategy using ISS-Corporate’s comprehensive compensation data.

- Uncover best practices

- Make informed compensation decisions

- Support your CD&A narrative

- Develop an actionable plan for responding to investor concerns

CEO + NEO Compensation Coverage

6,000

GLOBAL COMPANIES

View executive compensation

by pay rank, role, or executive name.

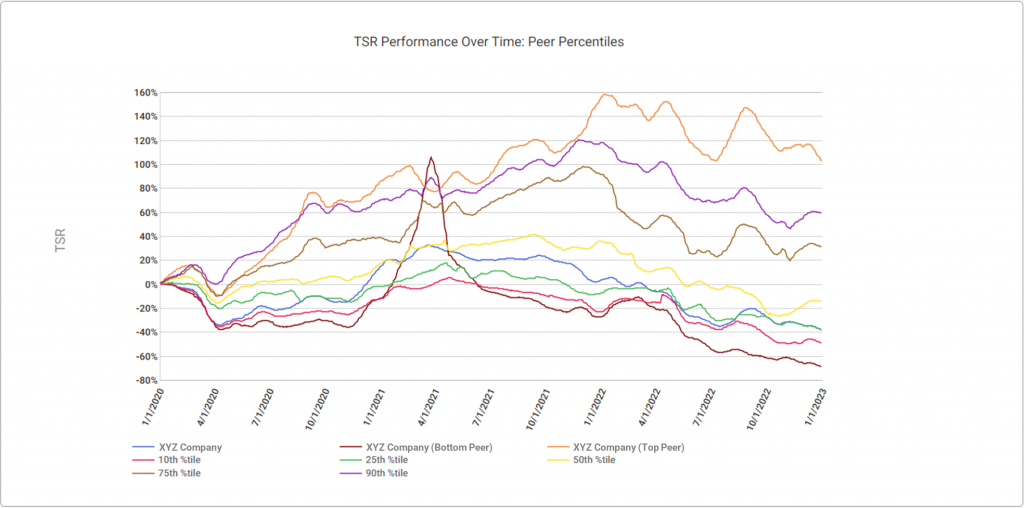

MEASURE AND TRACK TOTAL SHAREHOLDER RETURN

Utilize guided workflows to analyze absolute and relative Total Shareholder Return (TSR) Performance

- Define a performance period, select methodologies for price measurement and treatment of dividends

- Analyze results highlighting your company’s overall TSR performance and other key stats, and export reports to support a calculation audit

- Evaluate performance trends among a self-selected peer group, ISS selected peer group, custom peer group, or an index

- Track performance monthly or quarterly and identify leaders and laggards among peers and industry

DESIGN PERFORMANCE AWARDS, METRICS & GOALS

ISS-Corporate design services leverage the Award Simulator to establish a clear line of sight into the value and achievability of performance-based awards. The Award Simulator is a cutting-edge model incorporating Monte Carlo simulations and the best forecast data available to help you with metric selection, goal setting, and other design decisions.

Use the ISS-Corporate Award Simulator to:

- Goal setting to model payout probabilities and set appropriate goals

- Metric selection, including benchmarking of metric use by peers and industry trends

- Ongoing monitoring and tracking of awards during the performance period

- Guidance on presentation of award design designs

- Scenario Testing to compare alternate designs and build effective awards