ISS-Corporate QualityScore Premium Tools

Keep pace with what matters in Governance.

ISS Governance QualityScore

Governance Through the Investor’s Lens

Companies can use QualityScore to identify areas that investors may see as presenting governance-related risk and to inform their governance and compensation decisions.

The QualityScore offering for issuers provides premium tools to help companies stay abreast of emerging standards, peer practices, and shareholder priorities. Premium users can benchmark their practices against peers and model the impact of potential changes in their governance structure, thus gaining actionable insight on how to improve their governance practices and QualityScore rating.

What QualityScore Premium Tools Can Do For You

Be notified when scores or data for your company or peers have changed

Prioritize governance changes by identifying those that allow you to reach a specific score

Analyze & benchmark your practices against your peers

Generate reports to share with directors, executives & investors

Identify exemplar companies that embrace particular practices

Model how changes to your practices would affect your QualityScore

Governance QualityScore Advisory Support

Governance isn’t a one-size-fits-all proposition. Industry, company size, peers, ownership, shareholder base, and other factors can influence the governance decisions a company should make. ISS-Corporate’s expert advisory team understands these nuances and how to construct the right recommendations for you and your shareholders.

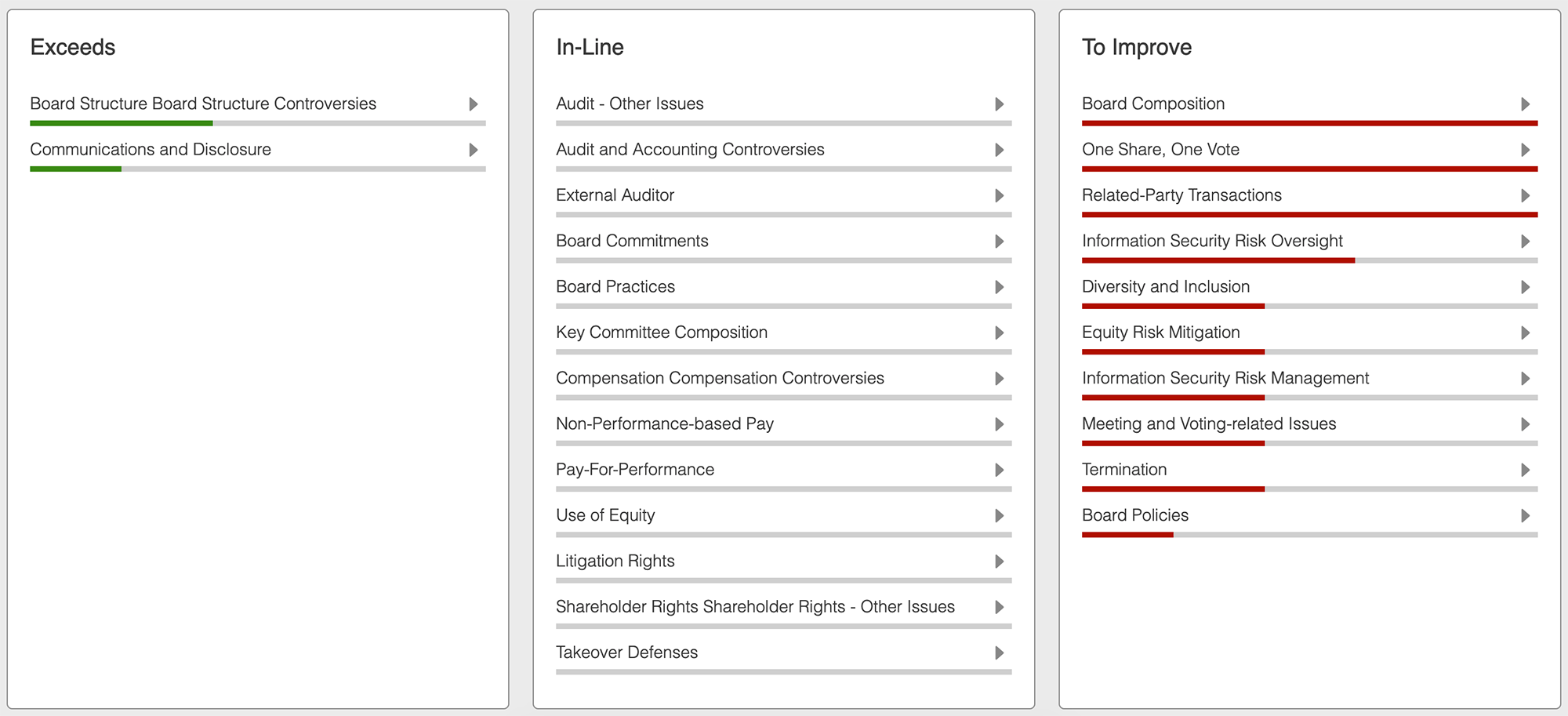

The following QualityScore subcategories are identified as areas where your company’s practices exceed, align with, or trail the Proxy Peers.

Coverage

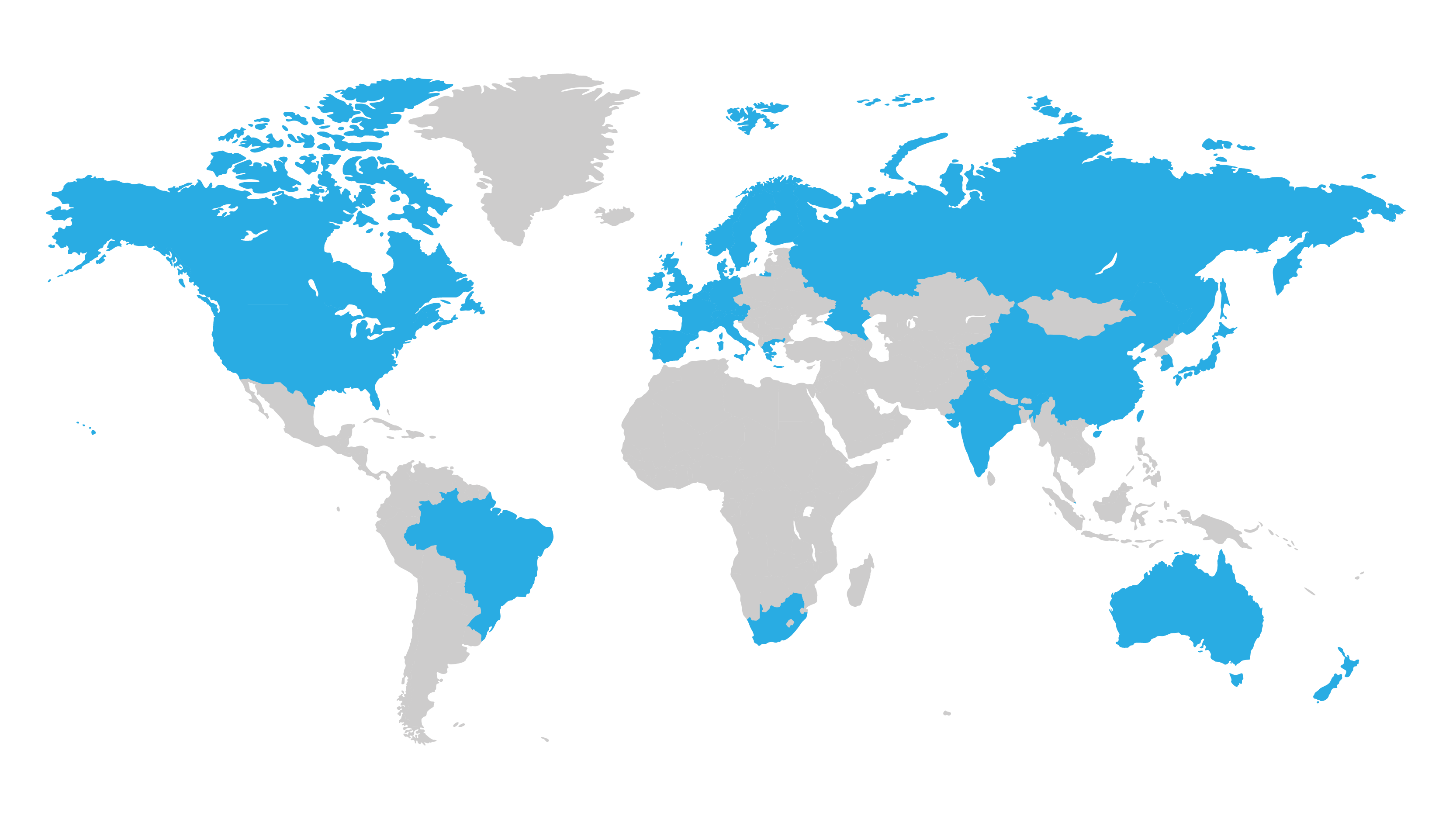

The QualityScore coverage universe encompasses 5,600 companies in 30 global markets, including the largest 3,000 corporations in the U.S.

Methodology

The ISS Governance QualityScore Technical Document details the questions analyzed and rationale for inclusion in the factor methodology.

Companies receive an overall QualityScore and are also assessed across four pillars: Board Structure, Compensation/Remuneration, Shareholder Rights and Takeover Defenses, and Audit & Risk Oversight.

QualityScore uses a numeric, decile-based score that indicates a company’s governance risk relative to its index or region. A score of “1” indicates governance risk in the lowest 10 percent of all companies, and, conversely, a score of “10” indicates governance risk among the highest 10 percent of all companies.

Governance QualityScore

Due to the relative nature of QualityScore, both events involving a company and events at other companies in its region may affect a company’s QualityScore.

Visit the ISS website to learn more about ISS Governance QualityScore, the underlying methodology, and scoring pillars

by clicking here