Prepping for the Trend: Stewardship Code Coming to Asia

Following the formal release of Stewardship Codes (“the Code”) in Japan, Malaysia, Hong Kong, and Taiwan, three other countries including Singapore, South Korea, and Thailand are following suit as a way of promoting sustainable growth as well as corporate and shareholder value by means of active voting and constructive engagement. The UK Code is modeled after by other codes, with nuanced differences. All codes are grounded on a “comply-or-explain” basis, mandate clear policies on stewardship, voting, and conflict of interest management, and encourage institutional investors to vote, to monitor and engage with investee companies, and to disclose the level of fulfilment of their stewardship.

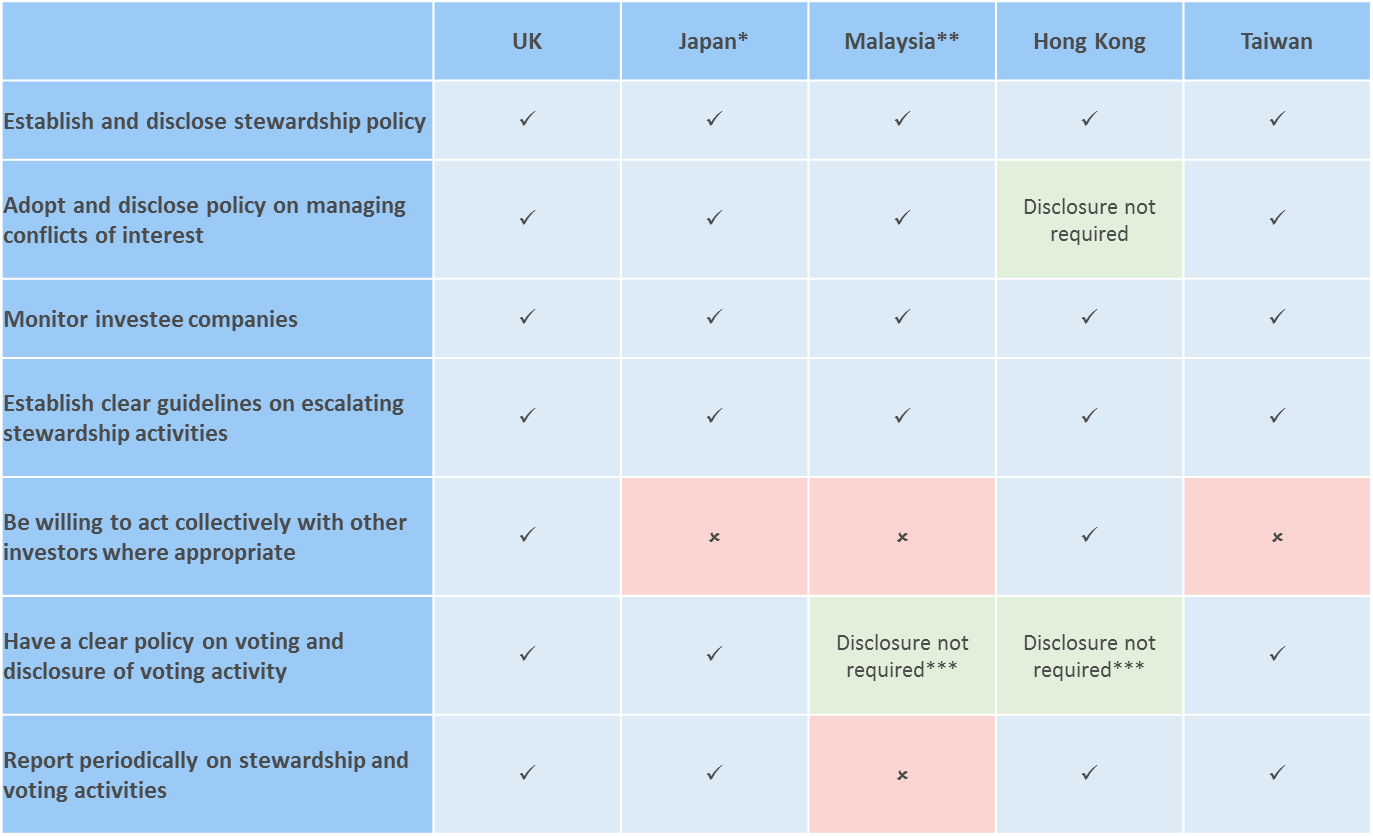

Stewardship Code Matrix – comparison with the UK Code

* The Japan code also requires institutional investors to contribute positively to the sustainable growth of investee companies

** The Malaysia code also requires institutional investors to incorporate corporate governance and sustainability considerations into the investment decision-making process

*** Disclosure to the beneficiaries or the clients is required when the institutional investor chooses not to vote

The landing of the Code in Asia is not without skeptics. As the characteristics and the dynamics differ vastly amongst the markets, how these countries juggle with the shared principles remains to be seen. Local institutions new to proxy voting may be burdened with the tremendous amount of work with respect to voting analysis and execution across their portfolio. Some also question if institutional investors are equipped with the understanding of their investee companies’ business and operations so as to construct purposeful dialogue with those companies.

Nevertheless, regulators in Asia seem to have agreed that institutional investors should play their part in the forging of the corporate governance culture in Asia. Institutional investors getting more active in Asia appears to be an irreversible trend. Communication with your shareholders on a regular basis is always a recommended exercise throughout the year to build a lasting relationship with them. Companies are encouraged to improve transparency and the quality of disclosure beyond the minimum regulatory requirement. Understanding the governance trend shall allow you to stay abreast of both upcoming regulatory updates, and new shareholder expectations. In addition, it is essential to understand the governance practices adopted by your peers which will help you stay competitive for capital both domestic and abroad. Frontrunners will also conduct routine evaluation of the companies’ corporate governance programs so as to assess the progress being made as well as to identify risks posed by evolving challenges.