ESG Solutions for Vendors

The Complete Picture in ESG Disclosure and Performance

More and more companies are measuring and managing ESG risks in their supply chain as part of their standard procurement and vendor management processes.

ISS-Corporate’s ESG Solutions for vendors offers industry-leading research and detailed data on companies to help procurement teams and vendor managers minimize ESG risks, comply with evolving regulatory and stakeholder requirements and seize opportunities within their supply chains.

Two-thirds of the average company’s environment, social, and governance footprint lies with suppliers.

(McKinsey & Co)

UN Global Compact participants rank supply chain practices as the biggest challenge to improving their sustainability performance.

(United Nations Global Compact)

A survey of global supply chain leaders suggests a significant gap between having an ESG strategy in place: only 36% of respondents have access to the required technology and data to drive their ESG strategy

(Finextra)

Who we are

Since our beginnings in 1997, ISS‑Corporate has upheld a legacy of providing market-leading expertise that empowers companies to meet the growing demands of incorporating governance and sustainability principles across the enterprise.

Partnering with stakeholders, we continue to design innovative products that keep pace with business needs.

SUPPLY CHAIN ESG RISK MANAGEMENT

ISS-Corporate’s ESG Solutions allow organizations to quickly build ESG performance evaluation and risk management into their supply chain and overall vendor management program, customized to their own risk appetite.

ISS ESG scores and ratings are structured around industry-specific materiality assessments and informed by publicly accepted disclosure frameworks such as SASB, GRI and TCFD, to assess the most applicable and impactful ESG-related transparency and performance issues companies face. Whether it is detection and screening of companies with ESG-related controversies, evaluation of contributions to the UN SDGs, or assessment of a company’s underlying sustainability performance for the issues most material to its specific industry, ISS-Corporate has the data and research to support your efforts.

EXPLORE ISS-CORPORATE ESG SOLUTIONS

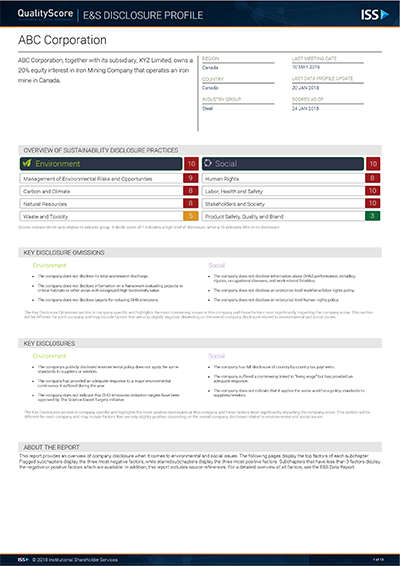

ISS E&S DISCLOSURE & GOVERNANCE QUALITYSCORE

ISS Environmental & Social (E&S) and Governance QualityScore provides the complete ESG picture to evaluate companies’ transparency and disclosure practices using a numeric, decile-based score supported by robust underlying data.

Access to Governance QualityScore reports supports supplier and vendor managers as they consider governance in their quality analyses and incorporate unique compensation, board, and shareholder responsiveness data into risk management assessments.

Access to E&S Disclosure QualityScore reports allows vendors to identify leaders and laggards in the industry.

E&S Disclosure QualityScore measures and identifies risk in environmental and social areas of concern through thorough analysis of company disclosures. Scores can also indicate best-in class disclosure practices and save time in performing peer comparisons.

Visit the ISS website to learn more about Governance and E&S QualityScore, the underlying methodology, and scoring pillars.

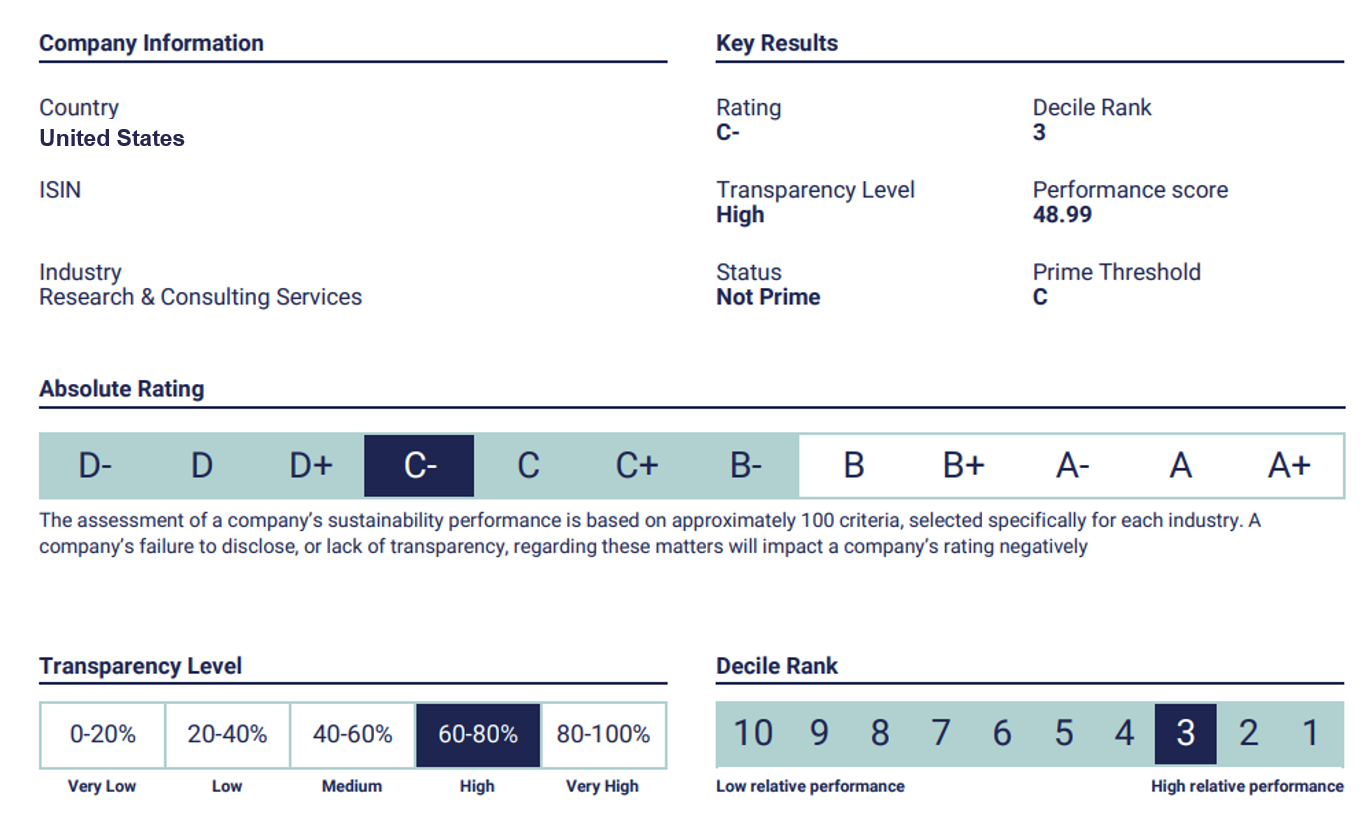

ISS ESG CORPORATE RATING

The ISS ESG Corporate Rating provides forward-looking ESG data based on true company performance. A company’s management of ESG issues is analyzed on the basis of up to 100 mostly sector specific rating criteria. The indicators are constantly reviewed and developed to align with latest scientific findings, technological developments, regulatory changes and the social debate.

ISS ESG CORPORATE RATING REPORTS INCLUDE:

- A summary of key results, including the company’s absolute rating, normalized performance score, transparency level and Prime status

- A list of industry leaders and associated ratings as well as an industry rating distribution

- The company’s performance relative to the industry average across a set of industry-specific key issues

- Rating history

- Analyst opinions of the company’s sustainability risks and opportunities and a governance overview

- A detailed breakdown of scores and analyst explanations for each applicable underlying dimension, category, topic, and indicator

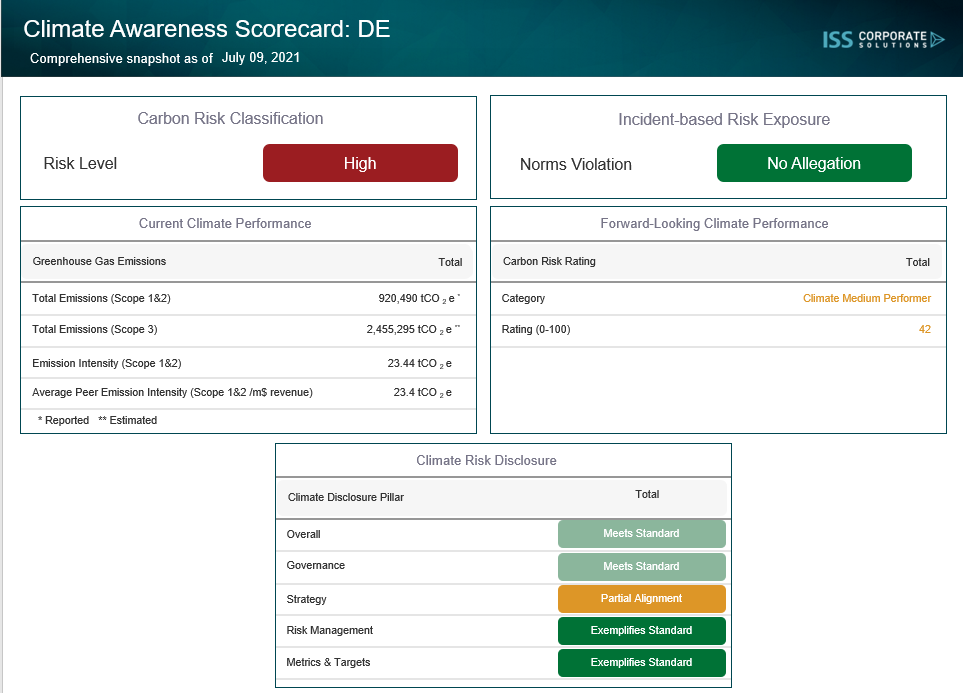

CLIMATE AWARENESS SCORECARD

The ISS Climate Awareness Scorecard reflects publicly disclosed data and reporting on a company’s climate change-related disclosures and performance using a range of factors, including its carbon risk classification. Companies are evaluated on overall disclosure (Governance, Strategy, Risk Management, Metrics & Targets) and performance factors (Norms Violations, GHG Emissions, Performance Ratings).

Access to ISS Climate Awareness Scorecard reports include a company’s:

- Industry-based Carbon Risk Classification

- Climate-related Incident-Based Risk Exposure

- Greenhouse Gas Emissions

– Scope 1 & 2

– Scope 3

– Emission Intensity (Scope 1&2/m$revenue)

– Average Peer Emission Intensity - Carbon Risk Rating

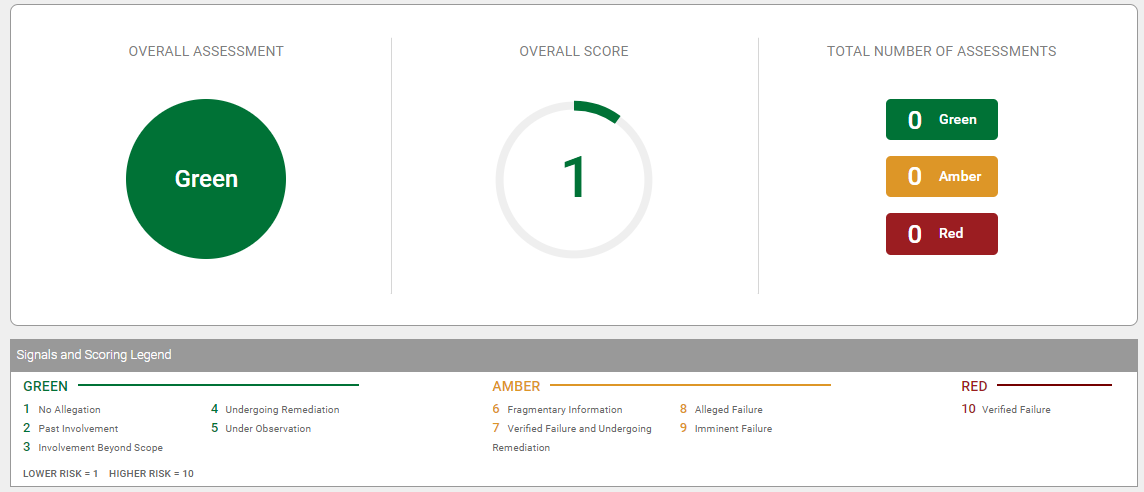

NORM-BASED RESEARCH

ISS Norm-Based Research assesses companies’ adherence to international standards for environmental protection, human rights, labor standards, and anti-corruption based on global norms as set out in the relevant international initiatives and guidelines, such as the UN Global Compact Principles. Access to reports helps uncover the most critical environmental and social risks for a given company, as well as their responsiveness to the issues.

ISS Norm-Based Research Reports include:

- Overall NBR score and tally of detected controversies categorized by severity

- Performance against the UN Global Compact Pillars

- Analyst commentary

- Latest ESG-related news

- Detailed summaries of any detected controversies, including severity, summary, context and key sources

UN SDG IMPACT RATING

The SDG Impact Rating provides a holistic metric of impact using the United Nations (UN) Sustainable Development Goals (SDGs) as a reference framework. The rating measures the extent to which companies are managing negative externalities in their operations across the entire value chain to minimize negative impacts, while at the same time making use of existing and emerging opportunities in their products and services to contribute to the achievement of the Sustainable Development Goals. The company’s impact is measured thematically, following the SDG framework, as well as at an aggregate level.

For each of the 17 SDGs, a company’s impact is determined by three pillars: (1) the company’s products and services; (2) the company’s operational management; (3) the involvement in and responsiveness to controversies.

SDG Impact Rating Reports include a company’s:

- Overall SDG Impact Rating

- Summary of overall key impact drivers

- Distribution of ratings within the industry

- Breakdown of SDG Impact Ratings and key impact drivers for each SDG

- Scores and industry distribution across Products & Services, Operations, and Controversies for each SDG