DATE PUBLISHED: July 31, 2023

ESRS: A New Chapter in Sustainability Reporting

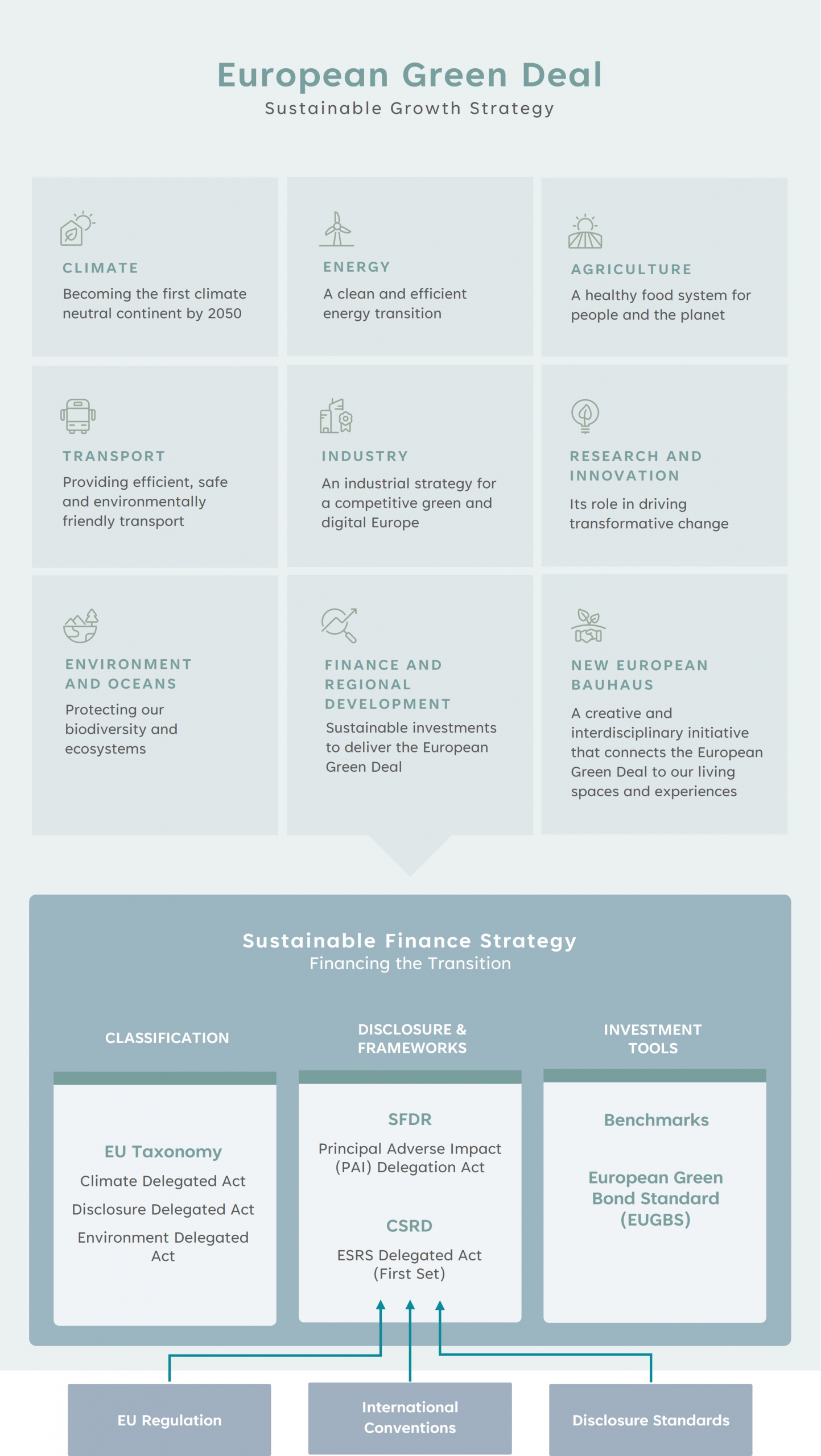

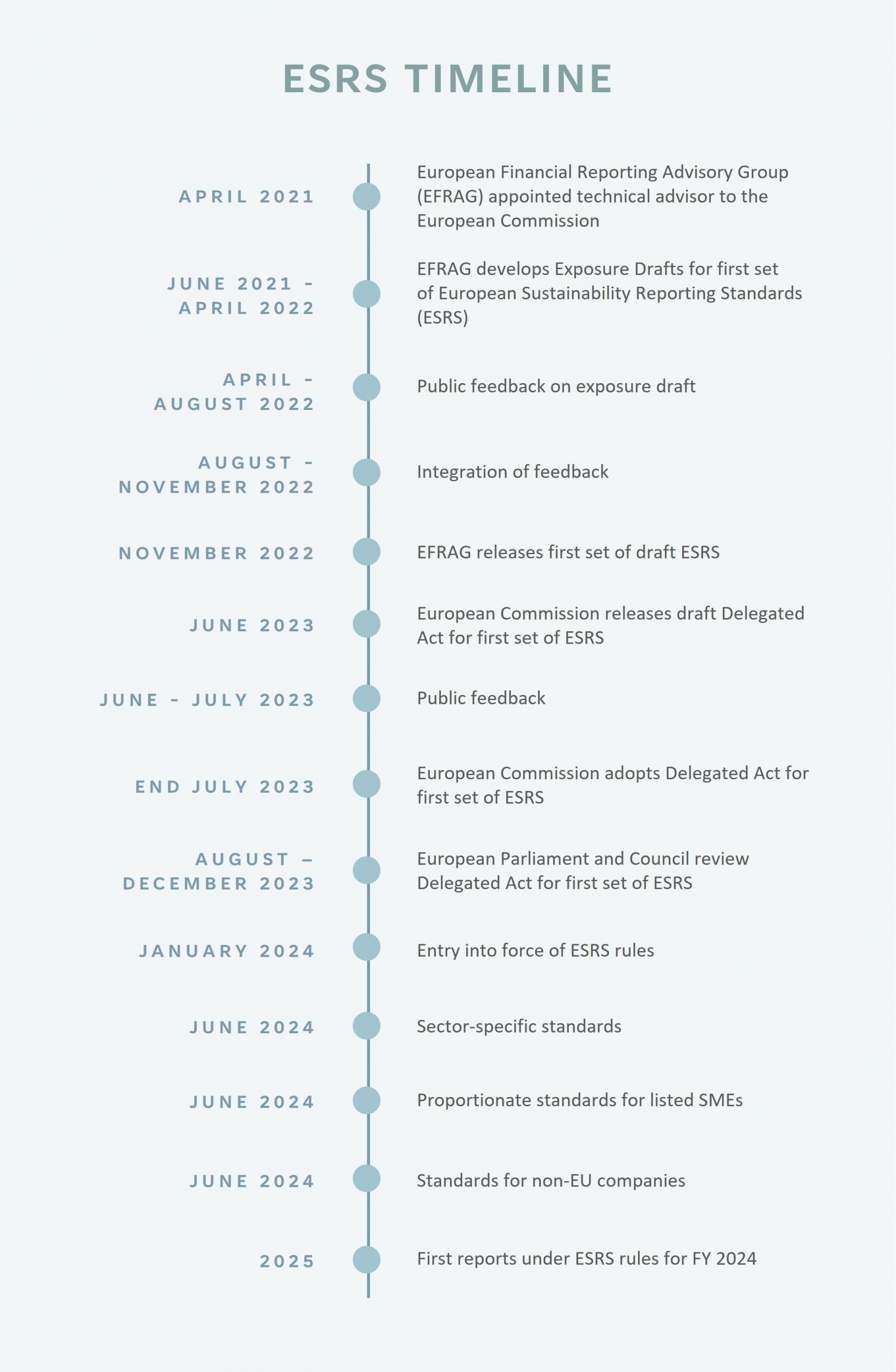

The European Commission today adopted the first set of European Sustainability Reporting Standards (ESRS) requiring companies to provide comprehensive and robust information about social and environmental impacts, risks and opportunities to a broad group of stakeholders. The new standards seek to support the European Green Deal by making available relevant, consistent, and comparable data under a new reporting framework, the Corporate Sustainability Reporting Directive (CSRD).

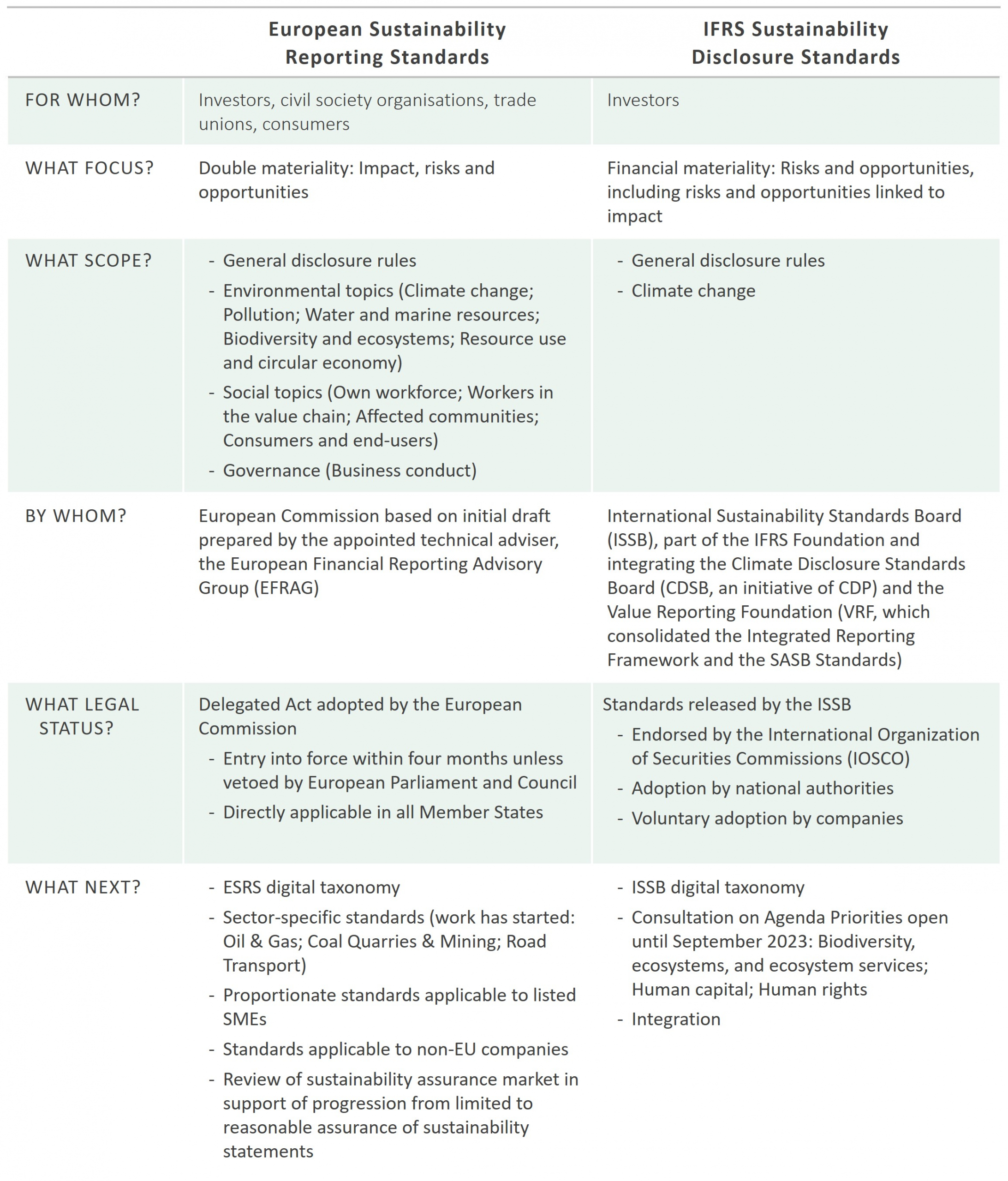

The release of the new disclosure rules by the Commission comes only five weeks after the International Sustainability Standards Board (ISSB) released its inaugural sustainability disclosure standards. Both sets of rules, while representing substantially different perspectives on the core concept of materiality signal an unprecedented level of awareness globally of the urgency of addressing and seeking to mitigate the unfolding climate crisis. Yet the scope of ESRS extends far beyond the topic of climate change – in line with the EU’s broad environmental and social commitments under the sustainable growth strategy. Will the new disclosure rules deliver on the lofty expectations? Will they contribute to guiding and accelerating companies’ sustainability programmes – or lock valuable resource in into ever more complex reporting efforts? Is the level of harmonization achieved sufficient to offset the burden of more ambitious disclosures?

Key features of new disclosure rules

Can disclosure rules drive sustainability performance?

The new disclosure rules define what qualitative and quantitative information companies should make available, demanding transparency around sustainability targets and metrics, and accountability for sustainability governance, business strategy and, critically, sustainability due diligence. This will inform investor decisions, as well choices made by employees, consumers, and business partners. Increased transparency and accountability are ultimately expected to drive improved sustainability performance.

This also applies to one of the core concepts in ESRS: sustainability due diligence, which guides companies in identifying, preventing, mitigating, and accounting for how they address actual and potential adverse impacts. While ESRS does not impose conduct rules, it sets out the information to be made available about the due diligence process.

Will investors have access to relevant, consistent, and comparable data?

The lack of access to reliable data is widely viewed as a key obstacle in sustainable finance. While the new disclosure rules seek to address this, they should not be expected to generate large volumes of immediately comparable data from the start. Both IFRS Sustainability Disclosure Standards and ESRS include a large amount of narrative and descriptive indicators that require further analysis. Digital taxonomies are currently under development under both frameworks to help identify and extract comparable data efficiently.

Whether most disclosures should be mandatory or subject to a company’s own materiality assessment was arguably the most contentious aspect in the finalization of ESRS. The European Commission’s decision to remove climate change and certain workforce issues from the original list of mandatory disclosures has been met with criticism from investors dependent on this data to comply with ambitious reporting obligations under separate EU laws.

It remains to be seen whether the Commission’s resolution to subject all disclosure requirements, except for those specified under a cross-cutting ‘General Disclosures’ standard, to a company’s materiality assessment will effectively support transparency and accountability while also reducing costs. Feedback submitted by companies and business associations reflected both concerns over resource-intense materiality assessments as well as, on the opposite front, relief over the drastic reduction of mandatory disclosures.

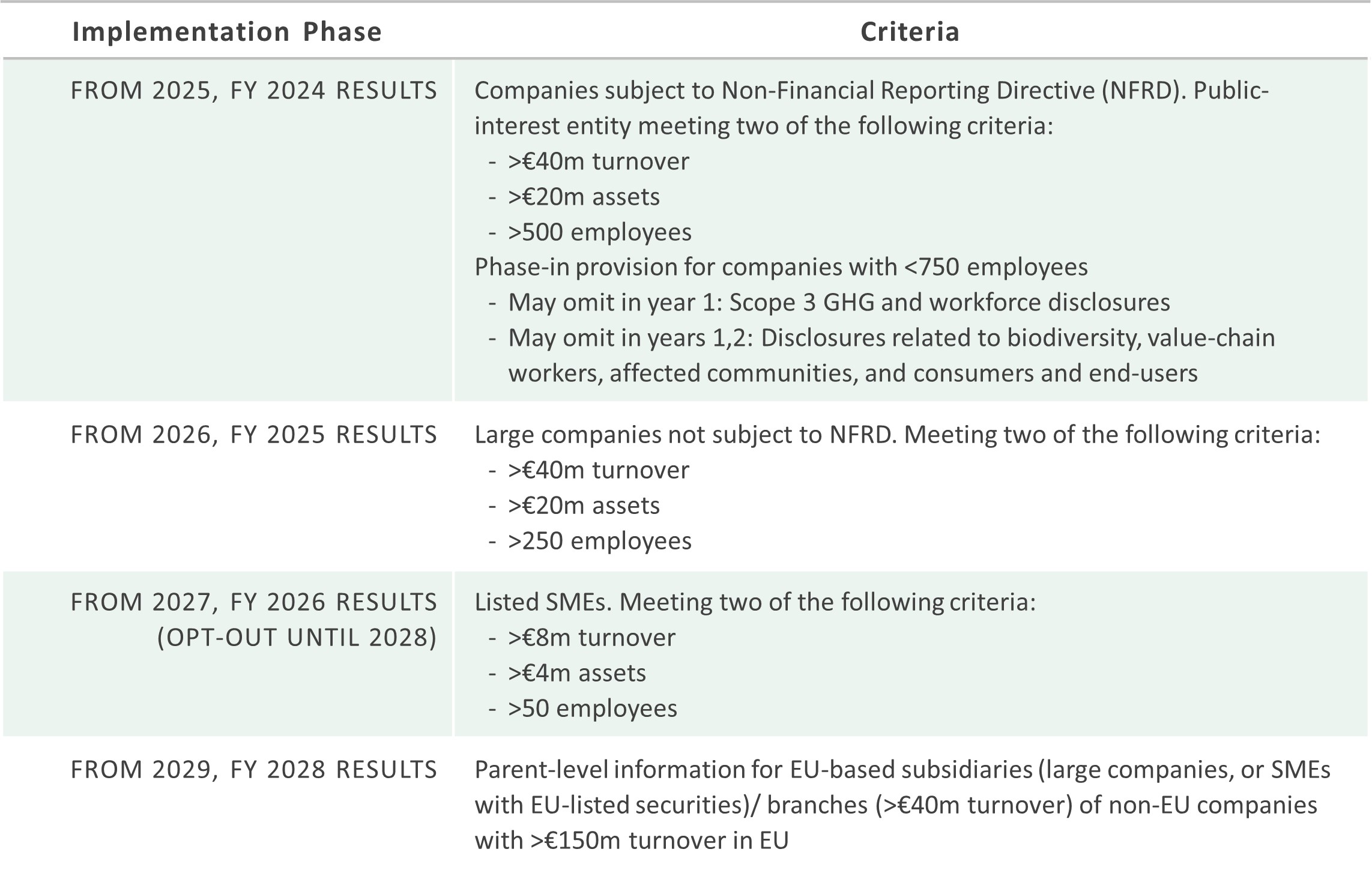

First disclosures under CSRD, applying the new ESRS, will have to be made already for financial year 2024 in reporting year 2025 (see below, CSRD: Applicability and implementation timeline). The new disclosure frameworks will therefore be relevant immediately to large companies, but their reach will extend far beyond that over time and should support deep market coverage of sustainability data. Coverage of the new EU rules will gradually expand, from an initial 11,500 companies to nearly 50,000 from 2026. Importantly, both ESRS and ISSB standards apply a value-chain approach to sustainability disclosures. The phase-in provisions put in place under both regimes in recognition of the resource burden for SMEs will delay the knock-on effect of disclosure requirements passed on to small suppliers and other business partners.

What level of harmonization has been achieved?

Work on the new standards has not only been guided by the objective to harmonize, but has also been accompanied by significant consolidation efforts. The architecture of the globally endorsed standard for climate change-related disclosures developed by the Task Force on Climate-Related Financial Disclosures (TCFD) informs the structure of both ESRS and the ISSB standards, providing a foundation for interoperability. The TCFD recommendations have been fully integrated into the climate change-related disclosure standards, ESRS E1 and IFRS S2. From January 2024, the ISSB will take on the TCFD’s monitoring responsibilities, signaling an important milestone in harmonization efforts. This comes after the consolidation under the ISSB of the Climate Disclosure Standards Board (CDSB) and the Value Reporting Foundation (VRF), which in turn incorporating the Integrated Reporting Framework and the SASB Standards.

EFRAG signed a cooperation agreement with the Global Reporting Initiative (GRI) to support “sustainability reporting convergence”. ESRS also incorporates the key concepts of foundational responsible business conduct guidance frameworks, the UN Guiding Principles and the OECD Guidelines for Multinational Enterprises, next to principles based on international conventions, e.g., ILO Conventions, and EU law. Going forward, it will be critical to ensure a high level of interoperability and alignment between the new disclosure frameworks to deliver on the commitment that harmonization will over time outweigh the cost of more comprehensive reporting.

Priorities: where to start?

- Strengthen sustainability governance

Disclosures around procedures, controls and practices for the oversight and management of sustainability matters are central elements of both ESRS and the ISSB’s standards. Information requirements about sustainability skills and competencies on committees and boards as well as the integration of sustainability-related performance in incentive schemes are likely to prove particularly challenging. Only 12% of S&P500 companies have at least one board member with climate change-related skills according to ISS Data, while 23% of them disclose the use of climate-related metrics in their incentive plans for executives.[1] The new disclosure rules will increase scrutiny of boards’ ability to determine the adequacy of such metrics and to monitor and evaluate performance against them. - Determine materiality

The information to be disclosed is largely based on a company’s materiality assessment under both ESRS and the ISSB’s standards. Nearly 85% of European large and mid-cap companies disclosed they had carried out a sustainability materiality assessment, according to ISS Data. That compares with 52% in North America. For small-cap companies, that drops to 62% in Europe and 24% in North America.[2] Companies already providing these disclosures will have a head-start, but they will still have to substantially adapt and expand their efforts to identify and assess salient sustainability issues under the new disclosure rules. The “double materiality” approach underpinning the EU framework demands companies identify and evaluate both their impact on people and the environment and the effect on their financial performance through engagement with stakeholders and experts, and on the basis of scientific research and scenario analysis. - Embed sustainability in business strategy

Sustainability is no longer managed in isolation but should be an integral part of long-term strategic planning. As a result, sustainability disclosures should be aligned with financial disclosures. Both ESRS and IFRS S1 emphasize the importance of connectivity between sustainability disclosures and financial statements and require the integration of sustainability disclosures in financial reports. Specifically, CSRD-compliant sustainability statements, based on the requirements set out in the ESRS and incorporating EU Taxonomy disclosures, must be integrated into the company’s management report.

CSRD: Applicability and implementation timeline

Look out for what is coming next

The release of the new sustainability disclosure frameworks signals monumental progress in the harmonization efforts in which key stakeholders globally participated over several years. It holds the promise of accelerating sustainable economic development through the availability of better data. But there is much work ahead. Both EFRAG and ISSB confirmed their commitment to deliver comprehensive guidance and tools, including the relevant digital taxonomies, to support implementation. Even so, the new frameworks will require major investments in developing technical expertise at all levels around individual sustainability topics, and in enhanced data gathering and reporting capabilities.

EU policymakers are not satisfied that disclosure rules alone will be sufficient to support the social and environmental commitments under the European Green Deal and the Sustainable Development Goals. A proposal for a Corporate Sustainability Due Diligence Directive, CS-triple-D, seeks to introduce rules of conduct, or due diligence obligations to prevent and mitigate the most harmful effects of business activities both within and outside the European Union. While discussions between EU institutions about certain aspects of the proposal are still ongoing, this very process has contributed to increasing awareness about the need for connecting the dots: core pieces in the large body of international conventions, global commitments and standards that this regulatory initiative is anchored in have been around for a decade or more.

The first half of 2023 has seen an unprecedented acceleration of regulatory and standard setting activity, all signs suggest that this will continue throughout the remainder of the year. By the end of this year, we expect to have a clearer picture of the global corporate sustainability project and how to measure and report on its progress going forward.

Notes:

[1] Governance Quality Score, data as of 21 July 2023.

[2] ESG Raw Data covering around 8,600 companies globally, data as of 20 June 2023.